Table of Contents

- The IRS has announced 3 key changes to 401(k)s for 2025 — here's how to ...

- Six Changes to IRAs and 401(k)s in 2025 | Kiplinger

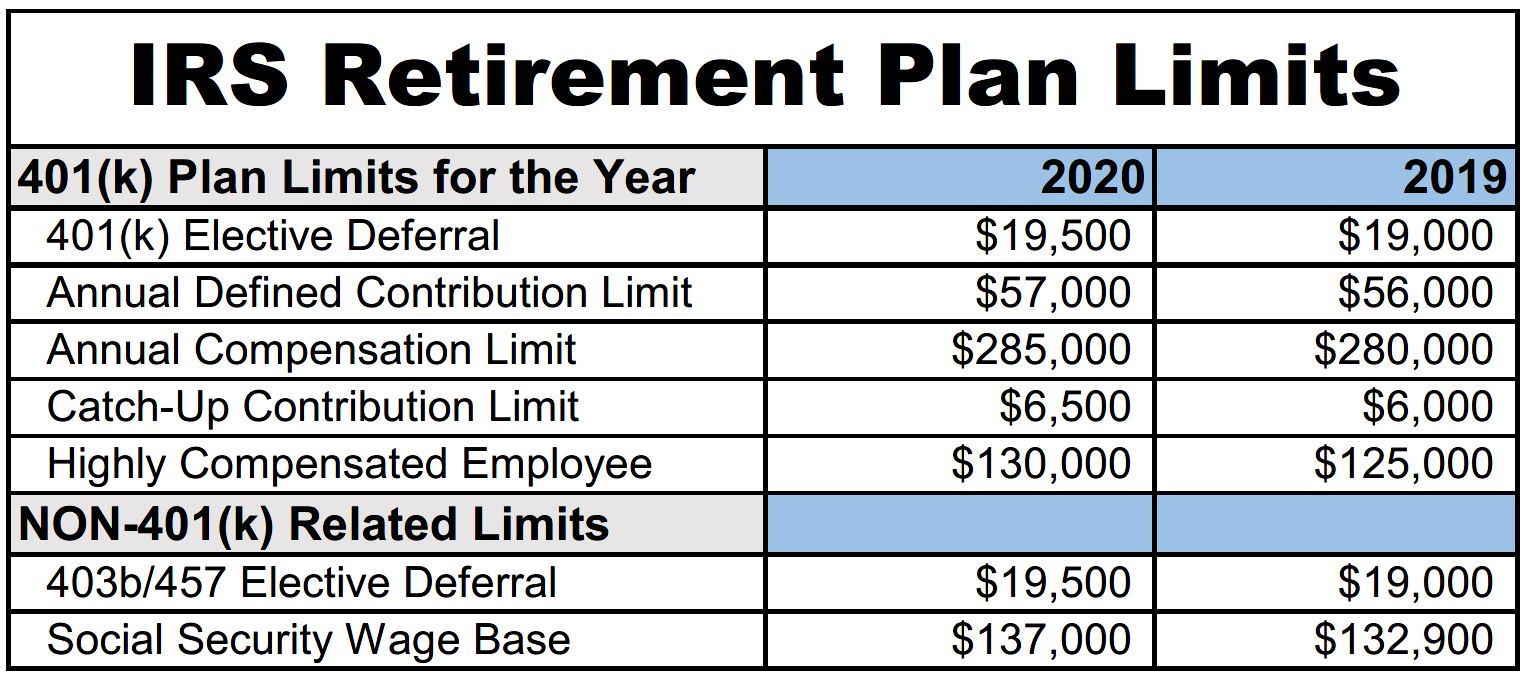

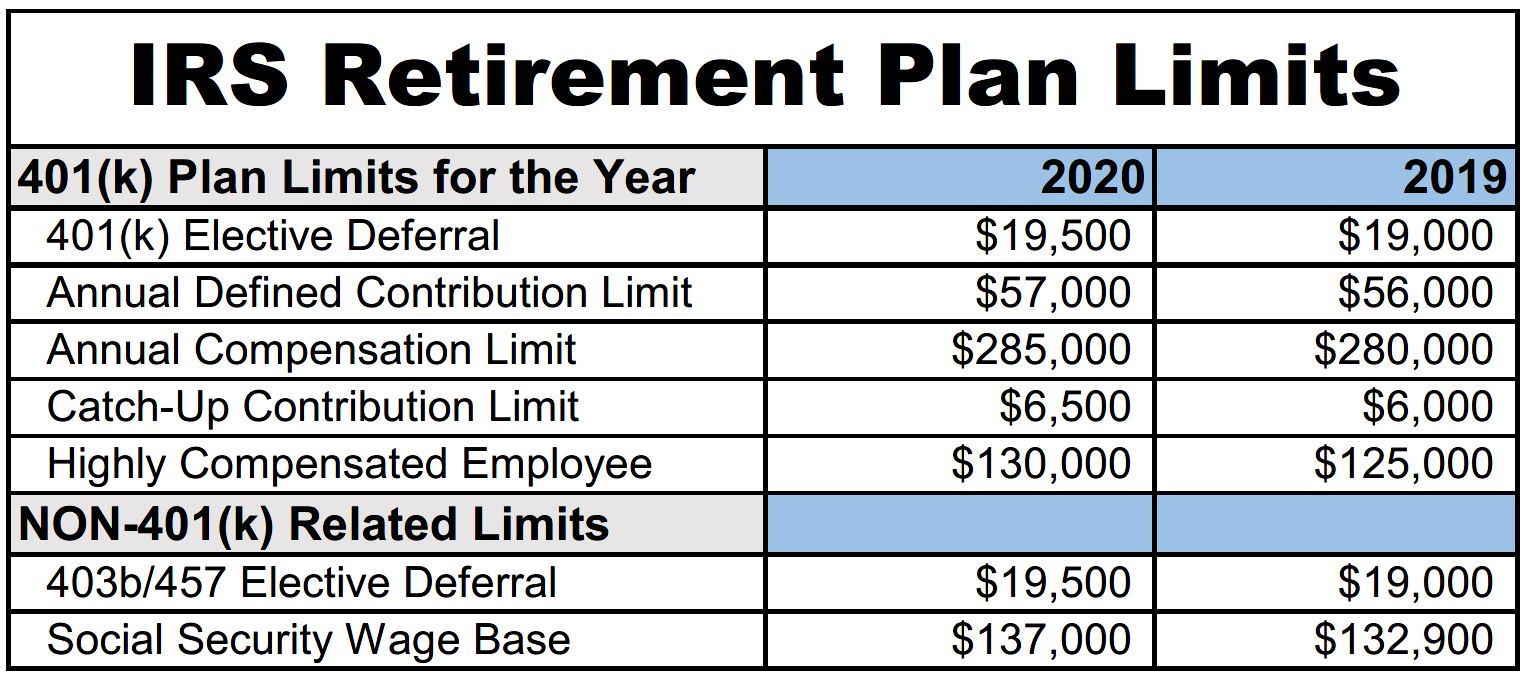

- Retirement Plan Contribution Limits Will Increase in 2020 | Global ...

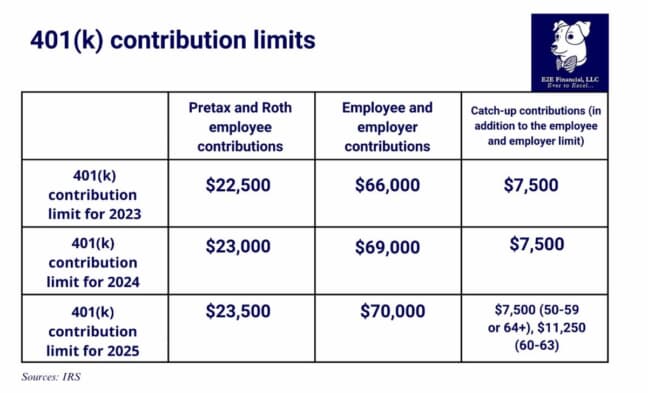

- Contribution Limit Increases For Tax Year 2025 For 401(k)s and IRAs ...

- 2025 401k Contribution Max - Emmy Norrie

- The NEW 2025 Retirement Plan Contribution Limits! KEY Updates Inside ...

- 401(k) Contribution Limits In 2024 And 2025 | Bankrate

- Contribution Limit Increases For Tax Year 2025 For 401(k)s and IRAs ...

- 2025 Max 457 Contribution Limits Over 55 - Tessa Whitakersa

- Retirement Plan Contribution Limits Will Increase in 2020 | Global ...

Introduction to 2025 Benefit Plan Limits

Key Highlights of the 2025 Benefit Plan Limits Chart

Importance of Staying Up-to-Date on Benefit Plan Limits

Staying up-to-date on the latest benefit plan limits and thresholds is crucial for HR professionals and employers to ensure compliance with regulatory requirements. Failure to comply with these limits can result in penalties, fines, and even plan disqualification. By referencing the 2025 benefit plan limits and thresholds chart, employers can: Determine the maximum benefits they can offer to their employees Ensure compliance with regulatory requirements Avoid penalties and fines Provide competitive benefits packages to attract and retain top talent In conclusion, the 2025 benefit plan limits and thresholds chart provided by SHRM is a valuable resource for HR professionals and employers. By understanding the key highlights of the chart and staying up-to-date on the latest benefit plan limits, employers can ensure compliance with regulatory requirements, avoid penalties and fines, and provide competitive benefits packages to their employees. As the new year approaches, HR professionals must prioritize reviewing and updating their employee benefit plans to reflect the new limits and thresholds.For more information on the 2025 benefit plan limits and thresholds chart, visit the SHRM website. Stay ahead of the curve and ensure your organization is compliant with the latest regulatory requirements.